Introduction:

Payroll service is a critical aspect of any business, but for multinational companies, it becomes an intricate challenge. Managing payroll across borders involves a myriad of tasks, from establishing legal entities in new countries to handling multiple international payroll providers and dealing with currency exchanges.

The consequences of errors can be significant, with the average payroll mistake taking top-performing companies 2-4 days to rectify, and lower-performing ones up to 10 days. This delay can feel interminable for employees waiting for their rightful compensation.

Setting Up International Banking: A Foundation for Accurate Payments

When expanding globally, it’s crucial to partner with the right authorization services and banking institutions. In international banking, you’ll primarily work with IBAN (International Bank Account Number) and SWIFT/BIC (Bank Identifier Code) for validation.

When transferring funds to your company’s international locations, you’ll need the organization’s BIC along with their unique account number or IBAN. This meticulous setup ensures that your payroll service can accurately and securely transfer funds to your international employees.

Leveraging Technology for Employee Data Management

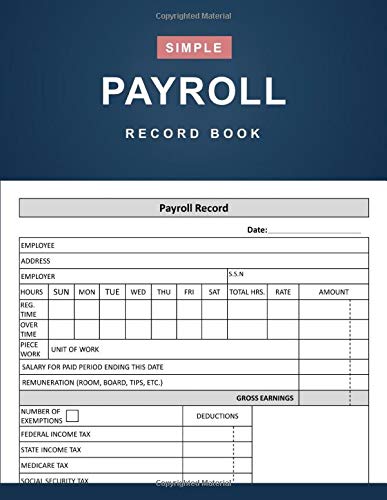

In today’s digital age, managing employee data efficiently is key to accurate payroll. Utilize a Human Resource Information System (HRIS) with dedicated payroll features that can handle calculations, non-recurring payments, and deductions. While not all HRIS systems automatically include these payroll-first features, implementing them can significantly enhance your payroll accuracy.

Moreover, protecting your employees’ personally identifiable information (PII) is not just good practice; in many countries, it’s a legal requirement. This data, collected during various administrative processes like applications, payroll enrollment, or benefit registration, must be securely managed to ensure compliance and maintain employee trust.

Staying Compliant: Continuous Monitoring and Automation

One of the most challenging aspects of international payroll is compliance management. Different countries have varying labor laws, tax regulations, and reporting requirements. To increase accuracy, reduce manual data entry as much as possible. While you might get away with manual entry locally, adding foreign regulations, exchange processes, and language differences into the mix can make errors nearly impossible to spot.

Automating compliance monitoring can help you stay on top of changes in local laws and ensure that your payroll processes adhere to the latest regulations. This not only reduces the risk of costly errors but also helps maintain your company’s reputation in foreign markets.

Choosing the Right Payroll Service Partners

During global expansion, you’ll encounter numerous service providers claiming to have the answers you need. When vetting potential partners, ensure they can back up their claims and that their services align with your processes and requirements for international operations. One way to verify these services is by requesting a SOC 1 (Service Organization Control) report, which provides insights into the provider’s internal controls relevant to financial reporting.

Look for partners who offer a consolidated solution, reducing the complexity of dealing with multiple providers across different countries. A trustworthy payroll service provider should have a proven track record of accurate and timely payments, robust security measures to protect employee data, and a deep understanding of local compliance requirements in each country they operate.

Last words

Accurate international payroll is a multifaceted challenge that requires meticulous attention to detail, robust systems, and reliable partners. By setting up proper banking procedures, leveraging technology for data management, staying vigilant on compliance, and partnering with trusted payroll service providers, multinational businesses can ensure their employees are paid accurately and on time, regardless of their location. In the global business landscape, a well-managed payroll is not just a legal necessity; it’s a cornerstone of employee satisfaction and a key driver of international success.